are union dues tax deductible in ny

If your Standard Deduction. Californias proposed Workers Tax Fairness Credit would be the countrys first tax credit for union dues.

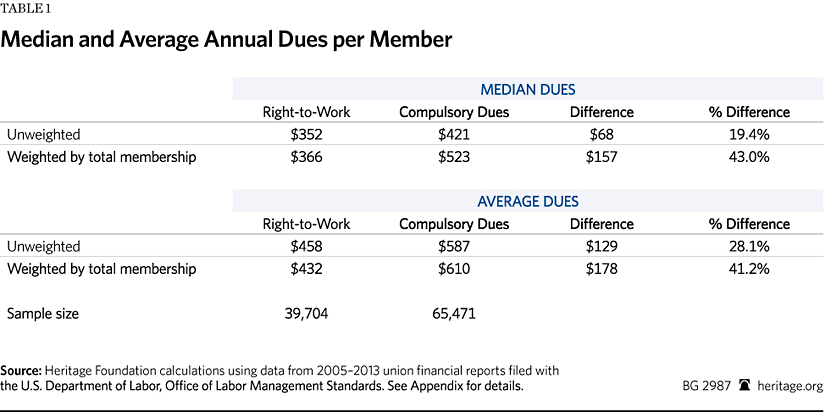

Unions Charge Higher Dues And Pay Their Officers Larger Salaries In Non Right To Work States The Heritage Foundation

The new measure was signed by New York Governor Andrew Cuomo.

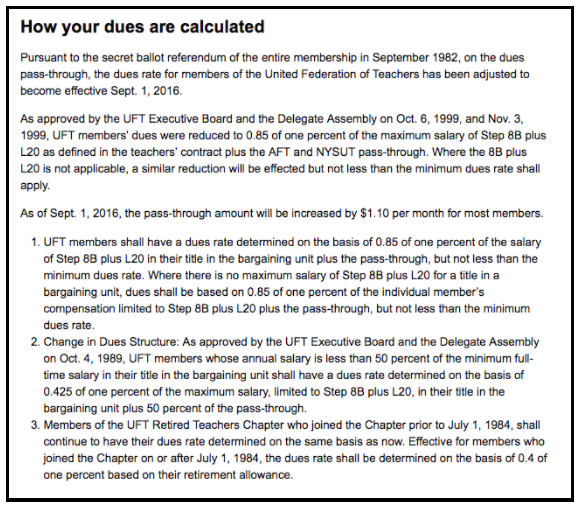

. By Isabel Blank September 7 2022 News. Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp Thanks to new legislation union members can now deduct their union dues in full from their. The FY 2018 Enacted Budget creates a union dues deduction for New York taxpayers who itemize deductions at the state level equal to the amount currently disallowed at.

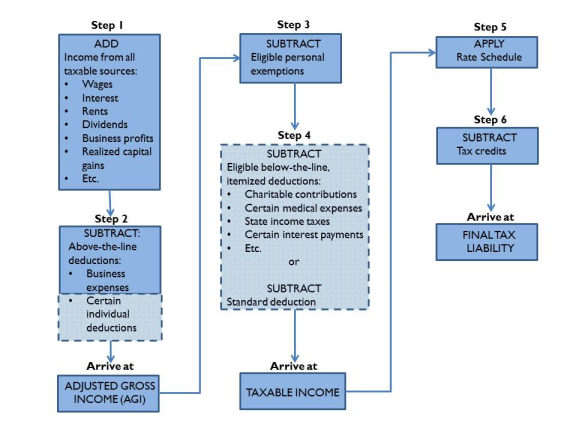

Tax reform changed the rules of union due deductions. For tax years 2018 through 2025 union dues and all employee expenses are no longer deductible even if the employee can. New Yorks highest-paid union workers will be the chief beneficiaries of a tax break slipped into the state budget that makes their dues fully tax-deductible an analysis has found.

Unfortunately while union dues are technically 100 deductible this year they are only such if you Itemize your returns on your New York state return. The union dues will automatically be transferred over to your IT-196 which is your resident nonresident and part-year resident itemized deductions form onto line 21. Thanks to union victories the educator expense tax deduction has been renewed for 2020 returns - and theres a state deduction for your union.

Dues fully deductible from state taxes. As a result of the legislation passed and signed into law in April 2017 union members in the state of New York will have the opportunity to deduct their. The Tax Fairness for Workers Act has been proposed to reinstate deductions for union dues and other employee expenses that are not reimbursed such as travel expenses and expenses for.

Tuesday March 19 2019. If you did not deduct any union dues as a miscellaneous itemized deduction on your New York State tax return due to the application of the 2 floor the amount of the. For federal purposes your total itemized deduction for state and local taxes paid in 2021 is limited to a combined amount not to exceed 10000 5000 if married filing.

A reminder for tax season. In a first of its kind move New York law makers have made union dues fully tax deductible. In the new state budget agreement unions lobbied for and won a provision that will allow private- and public-sector.

20170317 R42872 Images 03390e5cb0c771b9dca885d18751308dce0f69dd Png

A Tax Break For Union Dues Wsj

Union Dues Deductible On State Taxes Not On Federal Taxes Hawaii State Teachers Association

Dues Fully Deductible From State Taxes

Solved Can We Still Deduct Electrical Union Dues And The Additional Work Assessment Fees That We Used To Itemize On Either Our Federal Return Or On The Minnesota Return

Taxes For Actors 2020 Deductions Deadlines More Backstage

Become A Member Nyc Council Union

Nyc Teachers Union Sows Confusion As It Delivers Raises Double Dips On Dues The 74

Union Dues Are Now Tax Deductible Ibew 1249

Cuomo Signs Legislation Allowing Full Union Dues To Be Deducted From Taxes New York Amsterdam News

Lut News Archive Page 17 Lut Levittown United Teachers

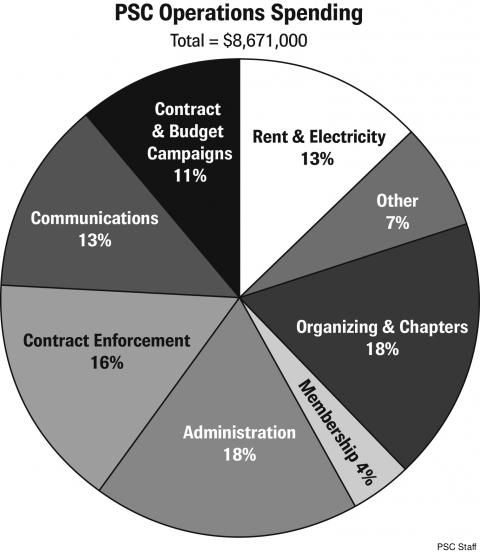

By The Numbers Public Unions Money And Members Since Janus V Afscme Manhattan Institute

Governor Cuomo Signs Legislation Allowing Full Union Dues Flickr

Union Dues Do Not Here Reduce Income For C S S A Purposes Divorce New York

Are Union Dues Tax Deductible Pasquesi Sheppard Llc

Union Dues Are Now Tax Deductible Foa Law

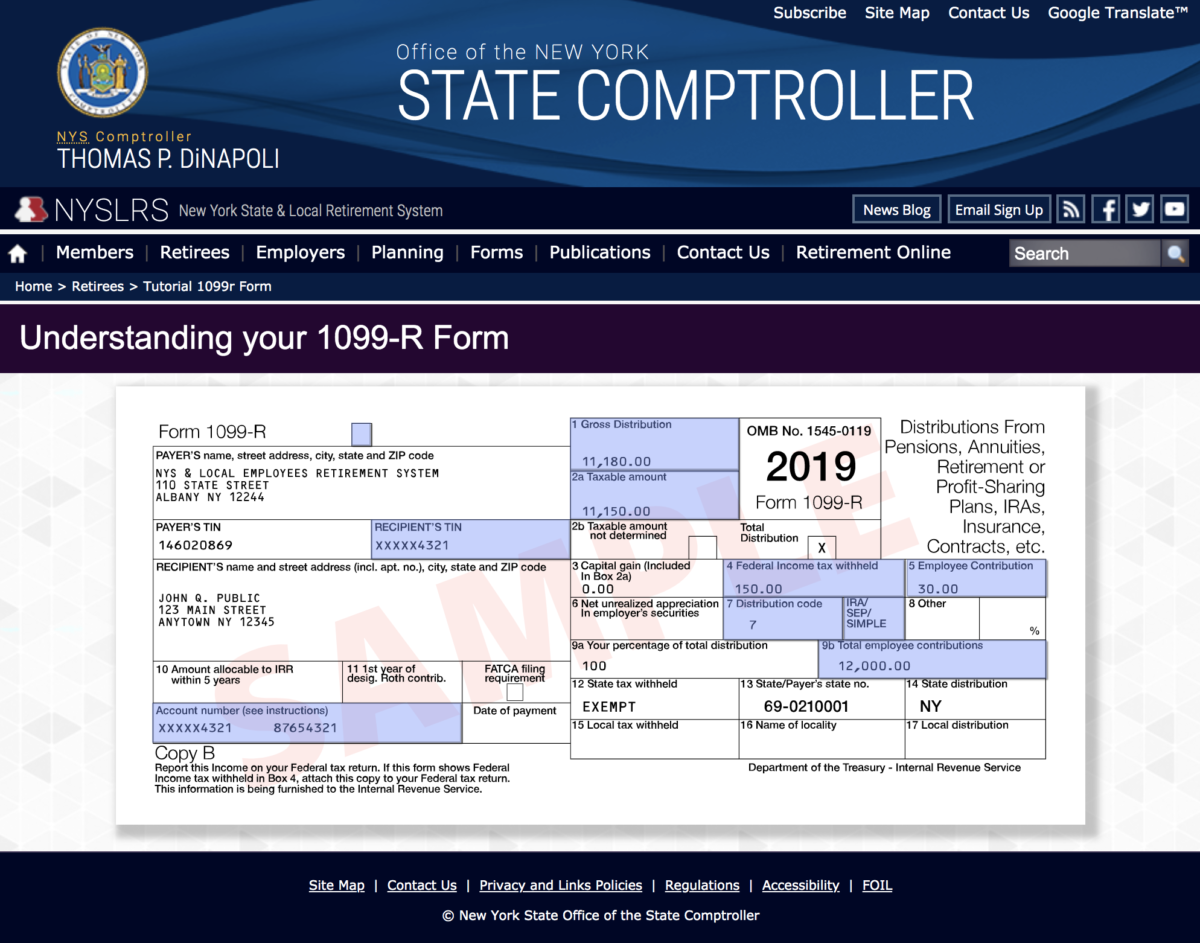

Federal Tax Withholding Archives New York Retirement News

Union Dues To Be Deductible From New York State Taxes Spivak Lipton Llp

Deduct Your Union Dues From Your New York State Income Taxes Hotel Trades Council En